El Viaje Redentor de Peter Kaldheim en “El Viento Idiota” Descubriendo “El Viento Idiota” – La épica transformación de Peter Kaldheim En

More¿Qué libro prohibido buscaban los personajes de “Hombres buenos” de Arturo Pérez-Reverte? Descubre “Hombres buenos” de Pérez-Reverte: Aventura Literaria en la Ilustración

More¿Cómo Transformar la Gestión Empresarial en Solo 50 Minutos? Descúbrelo con “El nuevo mánager al minuto” 🌟 Transforma tu liderazgo y eficiencia

More¿Cómo Aprender Inglés de Manera Efectiva? Guía Completa por Niveles. Los Mejores Libros y Recursos 📘✨ Te voy a aconsejar algunos de

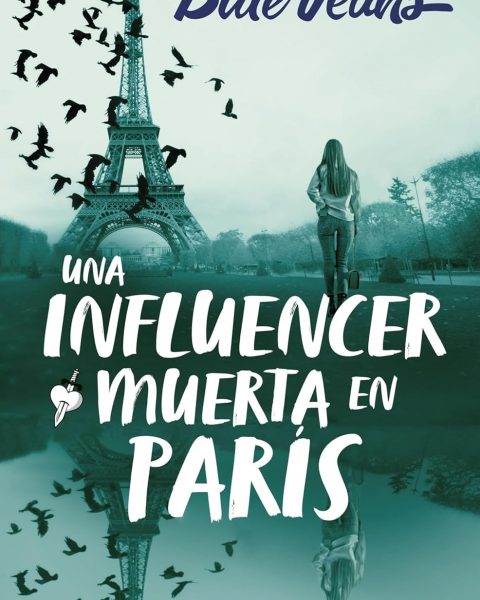

More¿Quién es Blue Jeans, el escritor que revoluciona la literatura juvenil desde París? 📚✨ Descubre a Blue Jeans: El fenómeno español que

More¿Quién es Anna-Marie McLemore? Una voz que susurra entre lo real y lo mágico Conoce a Anna-Marie McLemore: Un viaje literario entre

More¿Cómo Convertirse en un Experto del iPhone 12 Pro sin Esfuerzo? Guía Definitiva para Principiantes 📱✨ Adentrarse en el universo del iPhone

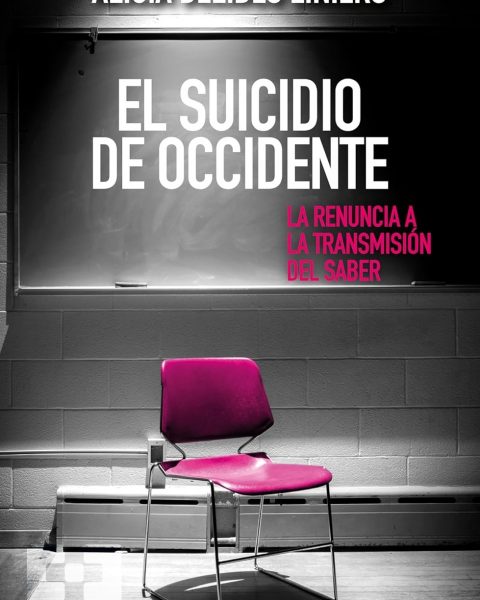

MoreEl Intrigante Declive Educativo: Desentrañando “El Suicidio de Occidente” 📚🔍 “El Suicidio de Occidente”: Análisis, Crisis Educativa y Soluciones Futuras 🌍🎓 En

MoreEl lobo de los cuentos: Cuentos infantiles de 3 a 6 años Elena Gromaz Ballesteros (Autor) (1)Fecha de publicación: 29 de noviembre

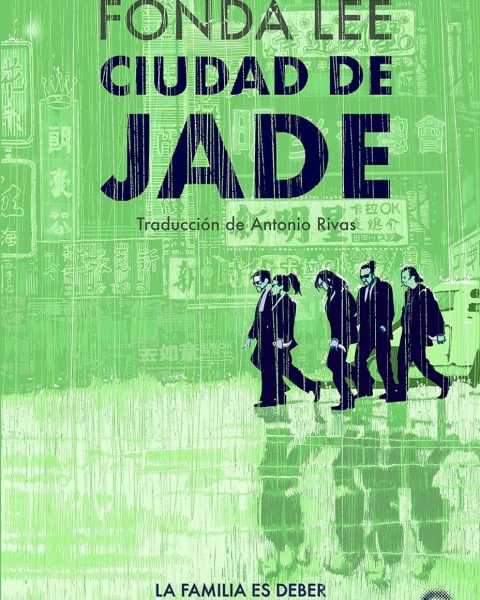

MoreMagia y Mafia bajo la Sombra del Jade: Descubriendo la Ciudad de los Secretos 🔮✨ Una Saga de Honor y Familia 🐉🏮”

MoreCésar Pérez Gellida: Maestro de la Novela Negra con Más de 300.000 Lectores. César Pérez Gellida: El Arquitecto de la Sombra en

MoreWhatsApp, Misterio y Crimen: El Enigma de “Loor” Desvelado 🔍📲💔 Un mensaje que lo cambia todo ¿Un WhatsApp puede ser el inicio

MoreSuspense y Secretos Bajo el Sol de Extremadura: Un Viaje Literario Retro con “Bajo Tierra Seca” 🔍📚 El enigma de una hacienda

MoreENTREVISTA: La Visión Profunda en “Intemperie” de Jesús Carrasco, un Análisis Futurista META TITLE: “Descifrando ‘Intemperie’: Entre Líneas con un Espía Literario”

MoreMistborn. Imperio Final - Nueva Edición (NB NOVA) Brandon Sanderson (Autor), Rafael Marín Trechera (Traductor) (49)Fecha de lanzamiento: 7 de septiembre de

MorePresencias Góticas: Un Viaje Literario Futurista al Corazón del Terror 📚✨ Explora el Futuro del Pasado con “Presencias”: Terror Gótico Renovado ✨📚

MoreLos Mejores Libros para Inspirar a tu Equipo a Alcanzar las Estrellas 🌟📚 🌟 Libros para Motivar Equipos 📚✨ En el universo

More¿Alguna vez has imaginado una mezcla tan loca como piratas, robots y hadas en una misma historia? Pues La increíble historia de un

MoreEl Viaje Fantasmal de Romana y Said: Un Relato de Suspense y Misterio 📚👻 Duración de un fantasma de Ismael Martínez Biurrun

Morevictor del arbol: El peso de los muertos – Nuestra historia esencial en ocasiones es solo un relato constituido por la imaginación.

MoreAño 3000 en la Ballena Europea, el país más poderoso de lo que un día fue el viejo continente europeo. Alguien ha

More¿Qué Esconde Javier Castillo? Desgarrando la Grieta del Silencio. 🕵️♂️📚Misterios y Éxitos Literarios Revelados 🕵️♂️🎉. En el corazón de la literatura de suspense

MoreWigetta Y El Báculo Dorado Vegetta777 (Autor), Willyrex (Autor) (12)Fecha de lanzamiento: 24 de noviembre de 2015 Cómpralo nuevo: EUR 19,90

MoreDe la página al escenario: cuando la literatura se convierte en teatro Desde sus inicios, la literatura y el teatro son dos

MoreTodo lo que debes saber sobre los armarios e invernaderos de cultivo interior La naturaleza es tan extraordinaria que te incluye en

MoreDel Borrador Escolar al Bestseller: La Odisea Literaria de Alexiel Vidam. Buenos días, soy Johnny Zuri y HOY quiero dar mi opinión

MoreLa Desaparición de un Ídolo: ¿Quién llorará por Jason Taverner? 🌌👁️ “Fluyan mis lágrimas, dijo el policía” – Un Viaje Futurista con

More